reverse mortgage

Seniors- Unlock Your Home Equity with NO Extra Mortgage Payments!

Are you aged 55 or older with a current low rate 1st mortgage and need to unlock your Home Equity without adding an additional Mortgage Payment? The Home Safe 2nd Mortgage will allow you to do that! Get the Facts here and Apply Today!

Explore The HomeSafe Second Mortgage!

The HomeSafe Second Mortgage is similar to a Reverse Mortgage.

You get a lump sum payment with no extra mortgage payments.

Minimum Credit Score = 600 with Financial Assessment

Minimum Credit Score = 680 with No Financial Assessment

Must have a current 1st Mortgage

Must be Aged 55 or Older

No Monthly Payment Required

Explore The HomeSafe Second Mortgage

A No-Brainer Solution for Seniors that need to access their home equity!

Your Home and Mortgage Needs

Are you struggling to cover your monthly expenses? Are bills mounting up and it's getting harder to make ends meet? The Home Safe 2nd Mortgage can give

Are you struggling to cover your monthly expenses? Are bills mounting up and it's getting harder to make ends meet? The Home Safe 2nd Mortgage can give you Peace of Mind without another monthly mortgage payment!

Apply Today!

you Peace of Mind without another monthly mortgage payment!

Home Repairs and Remodeling

Do you need to Remodel your home before you put it up for sale to make sure you get the highest sales price possible! The Home Safe 2nd Mortgage will allow you to remodel and repair your home to put it up for sale OR to Remodel and Repair your home to help you live a more comfortable life while you age in place!

Retirement Planning

Do you need more cash to live a comfortable life OR Maybe you are looking to travel more or buy yourself a second home! The HomeSafe Second Mortgage will give you the cash to live life to the fullest!

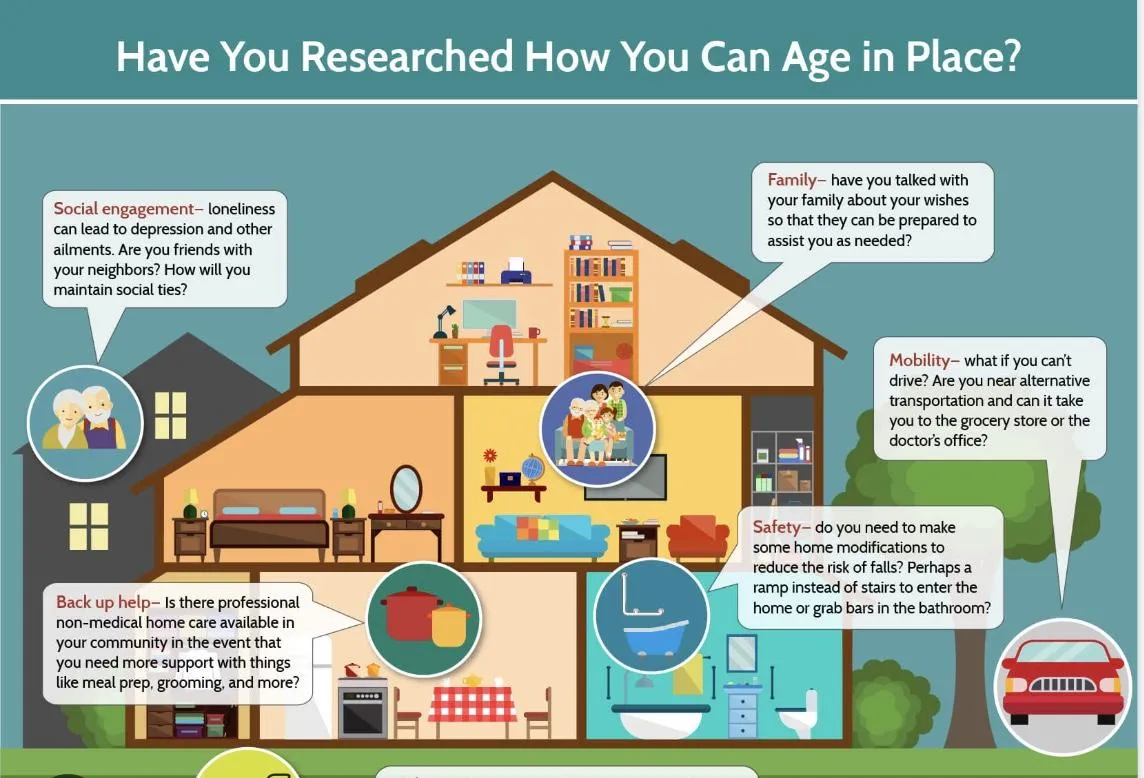

Use Your Home Equity to Age in Place!

Do you need at home care but don't have the means to pay? Do you want to Age in Place to maintain independence and avoid going into an assisted living facility? The Home Safe 2nd can help pay for your medical expenses and at home care so you can do just that!

What is the Minimum Credit Score for Home Safe Second?

The Minimum Credit Score is a 600 Credit Score with Income Verification. No Income Verification requires a 720 Credit Score.

Do I have a Mortgage Payment with Home Safe Second?

No. This is a Second Mortgage with No Monthly Payment. The Mortgage is to be paid off upon selling the home, refinancing, death or moving into assisted living facility. The Mortgage must be secured by your Primary Residence and there must be a 1st Mortgage in place.

Is there Mortgage Insurance with Home Safe Second?

No. There is NO monthly or annual mortgage insurance.

Is there a Pre-Payment Penalty?

No. There is no Pre-Payment Penalty.

What is the Minimum and Maximum Loan Amount?

The Minimum Loan Amount is $50k and the Maximum Loan Amount is $2 Million

How do I apply and how long is the Process?

When you Apply you can expect a 30 day Mortgage Process. The first step is to Apply Online. Once you apply we will call you and go over your loan application, let you know if you qualify and what documents we need to get started. We will walk you through each step of the process to make sure this is an easy process for you!

COMPANY

LOAN PROGRAMS

FOLLOW US

Contact information

Danielle Damianov Branch Manager & Team Lead

Grow Funding Group Powered by NEXA & Axen Mortgage

9990 Coconut Rd.Ste. 333

Bonita Springs, FL 34135

786-359-7976

DanielleNMLS # 883539

Corporate Address : 3100 W Ray Rd STE 201 Office # 209, Chandler AZ 85226

Corporate NMLS #: 1660690

NMLS Consumer Access Link-

https://nmlsconsumeraccess.org/TuringTestPage.aspx?ReturnUrl=/EntityDetails.aspx/COMPANY/1660690

Texas Complaint and Recovery Fund Notice Click Here: https://bit.ly/3B5pAfzPrivacy

Copyrights 2025 | Grow Funding Group | Terms & Conditions